MACROPRUDENTIAL AND MONETARY POLICY

The global financial crisis has shown that the financial sector can generate shocks with significant and lasting effects on the real economy in terms of accumulation of imbalances in certain subsectors or excessive growth in lending as a whole, and practical experience shows that imbalances the financial stability are difficult to identify, being necessary to differentiate between effective responses and inefficient market responses arising from the emergence of market failures or externalities. Moreover, the significant reliance on the financial sector self-adjusting ability has led to an underestimation of the negative potential impact of increasing asset prices and leverage, not taking into consideration the systemic implications of these imbalances and the spillovers to the real economy. In policy terms, the global crisis has emphasized the need to go beyond a purely microprudential based approach to financial regulation and supervision, in favor of a systemic perspective.

Macro versus micro-prudential perspectives

| Macro-prudential | Micro-prudential | |

| Proximate objective | Limit financial system-wide distress | Limit distress of individual institutions |

| Ultimate objective | Avoid macroeconomic costs linked to financial instability | Consumer (investor and depositor) protection |

| Characterization of Risk | “endogenous” (dependent on collective behavior) | “exogenous” (independent of individual agents’ behavior) |

| Correlations and common exposures across institutions | Important | Important |

| Calibration of prudential controls | In terms of risks of individual institutions; bottom-up approach | In terms of risks of individual institutions; bottom-up approach |

Source: Borio (2003)

Over the last two decades, macroeconomic policy evolved to ascribe a leading role to monetary policy, with a fundamental focus on price stability. The framework of monetary policy was broadly converging toward one with an inflation target (explicit or implicit) and a short-term interest rate as a tool (Blanchard, Dell’Ariccia and Mauro, 2010). Experience gained in recent decades has shown that the countries with the lowest inflation rates have had the comparatively lowest interest rates and, consequently, more sustained investment and job creation. Policies based on a trade-off between inflation and unemployment have failed, leading to higher levels of both. The ESCB’s objectives are defined in Article 2 of its Maastricht Treaty as follows: “…the primary objective of the ESCB shall be to maintain price stability. Without prejudice to the objective of price stability, it shall support the general economic policies in the Community with a view to contributing to the achievement of the objectives of the Community as laid down in Article 2 of this Treaty. The ESCB shall act in accordance with the principle of an open market economy with free competition, favoring an efficient allocation of resources, and in compliance with the principles set out in Article 4 of this Treaty.”

Everything that can be carried out efficiently on a decentralized basis remains the responsibility of the national central banks (NCBs). This principle stems from that of subsidiarity laid down in the Treaty on European Union. While it is necessary to centralize decision-making, it would be inappropriate to centralize implementation, especially in a field where national practices are firmly rooted and relations with the banking and financial community are extremely important. With regard to the conduct of monetary policy, each national central bank thus remains the natural interlocutor of the credit institutions established in its country.

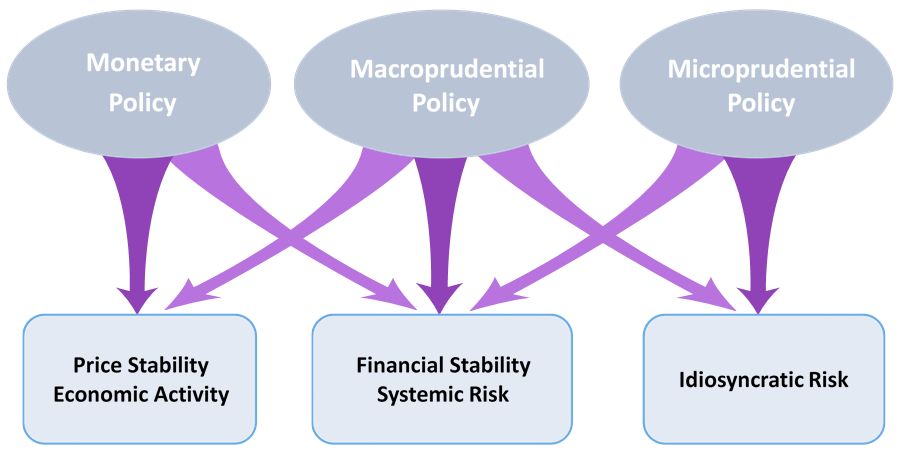

Using macroprudential policies to maintain financial stability, while monetary policy remains predicated to the achievement of price stability, is the current mantra. But with the progressive blurring of boundaries between central bank and financial regulator, policy makers are increasingly called upon to exercise expertise across the overlapping tasks of monetary, macroprudential, and micro supervision and regulation policy. While interest rates will continue to be the dominant instrument for implementing monetary policy, supplementing it by other quantity or macro-prudential instruments even in normal times will not only enhance the flexibility of monetary policy to attain multiple objectives but also could obviate the risk of hitting the zero lower bound. Concurrent deployment of multiple instruments also enhances the transmission of monetary policy which is impaired as policy rate moves close to the zero lower bound.

Interactions between monetary and prudential policies

Source: IMF (2013)

In the case of macroprudential policy objectives, several directions have risen in academic literature, with a common view that the primary goal is to maintain financial stability, by increasing financial sector resilience to external and internal shocks. Applying a systemic perspective allows policymakers to mitigate the risks and costs of financial crises and their impact on the real economy. Bank of England (2009) noted that in general terms, financial stability should aim at the stable provision of financial intermediation services – payment services, credit intermediation and insurance against risk – to the economy, trying to avoid the type of boom-bust cycles in the supply of credit and liquidity.

As macroprudential policy frameworks are being developed, policymakers are increasingly turning their attention to the relationship between macroprudential and monetary policies. The newly emerging paradigm is one in which both monetary policy and macroprudential policies are used for countercyclical management: monetary policy primarily aimed at price stability; and macroprudential policies primarily aimed at financial stability (IMF, 2013). The relationship between monetary and macroprudential policies hinges on the “side effects” that one policy has on the objectives of the other and how perfectly each operates in the pursuit of its own primary goal (Gerlach and others, 2009). These interactions can enhance or reduce the effectiveness of each policy in achieving its objectives and therefore suggest the need for coordination.

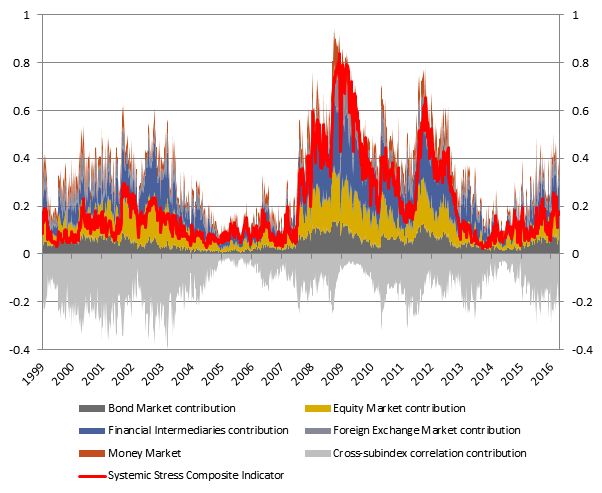

Assessing and monitoring systemic risk is a challenge for policy makers and supervisors in all countries. It is particularly challenging in low-income countries (LICs), owing to a number of characteristics shared to a greater or lesser extent by most of them (Catalán and Demekas, 2015). The main structural factors identified by the authors are related to lower diversification and higher macroeconomic volatility, lower institutional quality, less effective economic policy frameworks and specific stylized facts of the financial system (banking dominated, concentration of portfolios, foreign ownership, foreign exchange denominated loans and others).

Composite indicator of Systemic Stress (CISS)

Source: ECB SDW

The project proposes a multidimensional analysis of monetary and macroprudential policies in their close interconnection. The project will start with a conceptual review of how both policies would be conducted optimally considering their interactions. While structural models now available offer clear insights, they do not take into account important frictions that affect policy interactions in the real world. The project first focuses on an ideal benchmark, in which both policies work perfectly in achieving their objectives, and then we address three major questions:

• If macroprudential policies work imperfectly, what are the implications for monetary policy?

• If monetary policy is constrained, what is the role for macroprudential policies?

• If there are institutional and political economy constraints, how can macroprudential and monetary policies be adjusted?